Jennifer Lopez Anti-Aging Secrets: Why Age Never Caught Her

At 54, Jennifer Lopez doesn’t just defy age — she rewrites its rules. While most people chase youth, J.Lo seems to outgrow it, glowing stronger with every decade. This article…

Read more

The Shocking Brain Longevity Secrets Nobel Winners Lived By

How Nobel Science, Everyday Foods, and Brain Longevity Secrets Intersect What if the last chapter of your life could be the strongest, sharpest, and most fulfilling? Three Nobel Prize–winning scientists…

Read more

Nutritarian Diet Explained: Foods, Benefits, and Science

Introduction: Why the Nutritarian Diet Is Gaining Attention Chronic conditions such as heart disease, type 2 diabetes, and cognitive decline continue to rise worldwide. At the same time, nutrition…

Read more

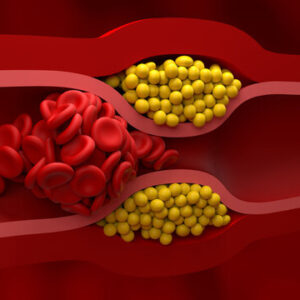

The Powerful Nutritarian Diet That Can Reverse Disease

Why the Nutritarian Diet Is Quietly Saving Lives Heart attacks. Strokes. Dementia. Here’s the uncomfortable truth: they don’t have to happen. That statement alone sounds radical in a world where…

Read more

The Shocking Food Secrets That Quietly Control How Fast You Age

What if aging isn’t written in your birth certificate—but on your dinner plate? What if every bite you take is either whispering “repair” or shouting “decay” to your cells? This…

Read more

Master Your Vitality: Life-Changing Water Habits for Longevity

You are what you eat, but have you ever considered that you are also exactly what you drink? Most of us treat water like an afterthought, a quick gulp to…

Read more